Blog

Decoding the Market: A Seller’s Guide to Pre-Owned Watch Value

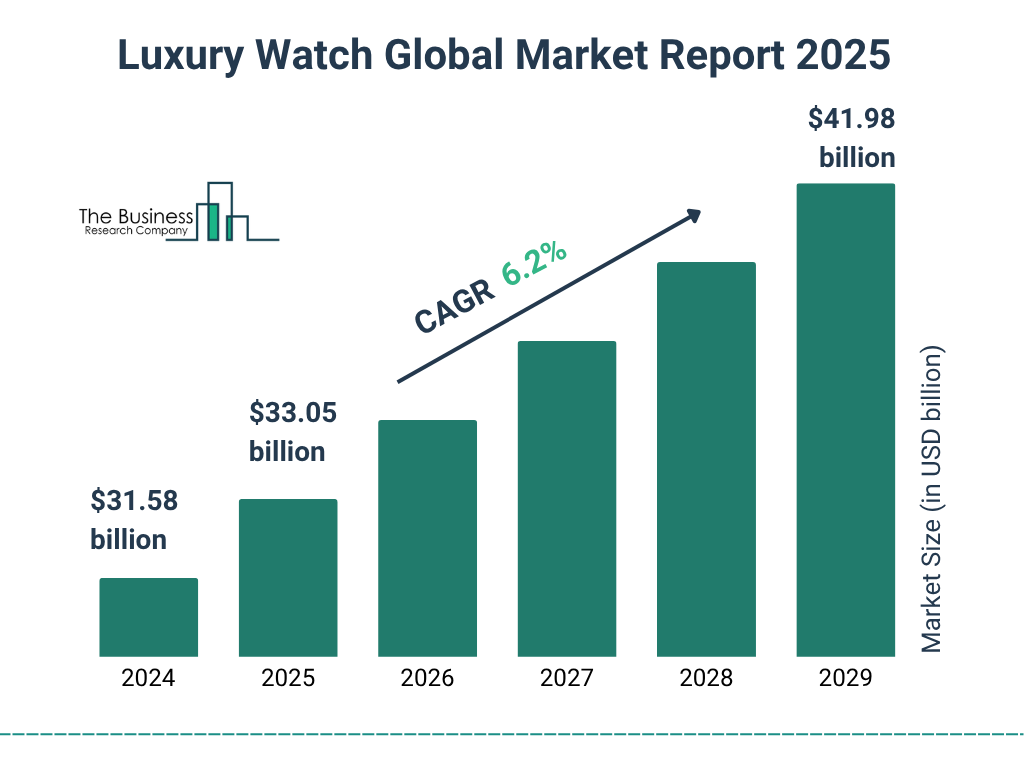

The luxury watch market continues its remarkable growth trajectory, with industry forecasts projecting sustained expansion through 2029.

The luxury watch industry stands at a fascinating crossroads where traditional craftsmanship meets modern market dynamics. As collectors and investors increasingly recognize timepieces as alternative assets, understanding how pre-owned watches are valued has become essential knowledge for anyone looking to enter or exit this sophisticated market.

The luxury watch market continues its remarkable growth trajectory, with industry forecasts projecting sustained expansion through 2029.

The luxury watch industry stands at a fascinating crossroads where traditional craftsmanship meets modern market dynamics. As collectors and investors increasingly recognize timepieces as alternative assets, understanding how pre-owned watches are valued has become essential knowledge for anyone looking to enter or exit this sophisticated market.

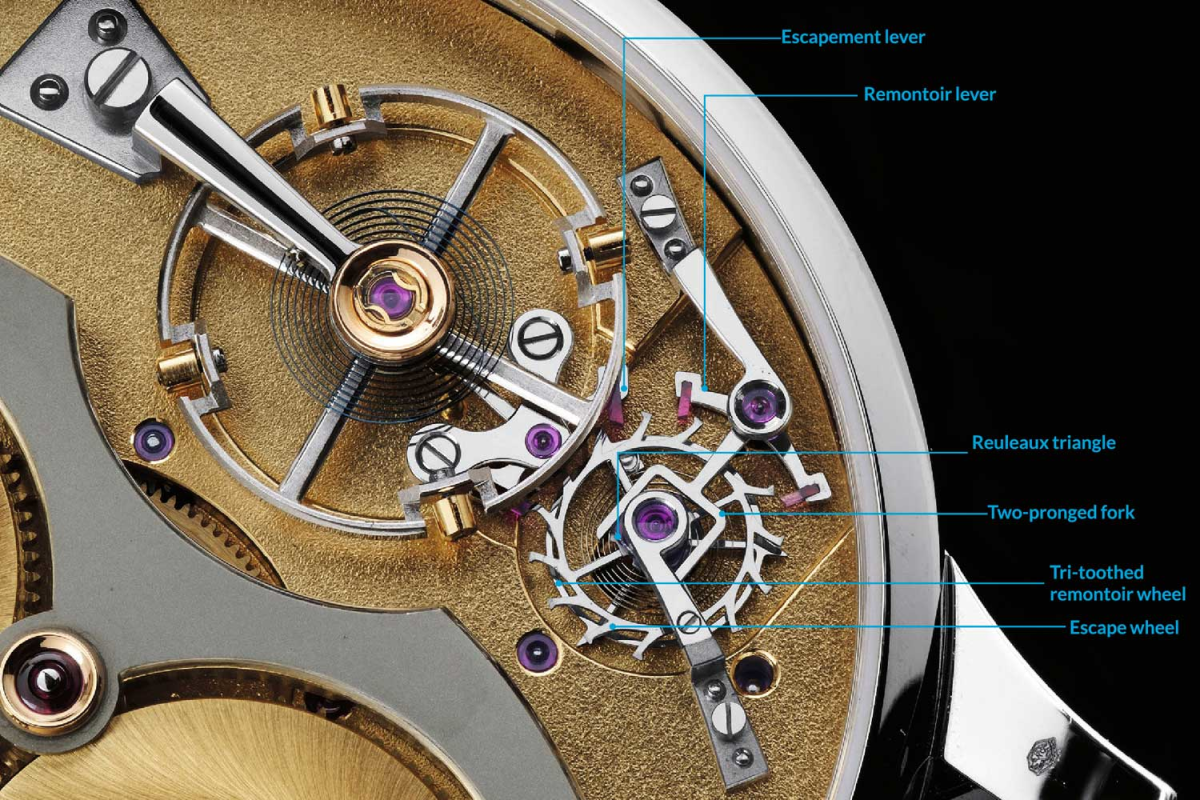

Investment-grade timepieces like this Patek Philippe represent the pinnacle of horological collecting, where provenance and documentation are as important as the watch itself.

This comprehensive guide reveals the intricate processes that determine a luxury timepiece’s true market worth, moving beyond simple retail comparisons to explore the complex ecosystem of brand heritage, collector psychology, and global demand patterns that shape today’s pre-owned watch landscape.

Whether you’re considering selling a cherished heirloom or evaluating a recent acquisition, understanding these market fundamentals empowers you to make informed decisions backed by industry expertise and transparent valuation methodologies.

The Foundation of Watch Value: Brand Heritage and Market Position

Brand reputation forms the bedrock upon which all luxury watch values are built. This isn’t merely about marketing presence or advertising budgets – it represents generations of accumulated trust, innovation, and cultural significance that translates directly into sustained market confidence.

The Undisputed Hierarchy: Holy Trinity and Blue-Chip Brands

The Holy Trinity — Patek Philippe, Audemars Piguet, and Vacheron Constantin — continues to define excellence in haute horology.

The watchmaking industry’s most prestigious tier consists of manufactures whose names alone guarantee exceptional resale performance:

| Brand Category | Key Characteristics | Market Performance |

|---|---|---|

| Holy Trinity (PP, AP, VC) | Centuries-old heritage, limited production | Consistent appreciation, auction premiums |

| Rolex | Global recognition, sport watch leadership | Exceptional liquidity, stable demand |

| Richard Mille | Ultra-modern materials, celebrity appeal | Premium pricing, instant collectibility |

Patek Philippe represents the ultimate expression of Swiss watchmaking tradition, where certain models like the Nautilus have achieved legendary status among collectors. The brand’s “generations” marketing philosophy has created an emotional connection that transcends typical luxury consumption patterns.

Audemars Piguet revolutionized luxury sports watches with the Royal Oak, creating a design language that remains influential fifty years after its introduction. The brand’s willingness to experiment with materials and complications keeps it relevant among contemporary collectors.

Rolex occupies a unique position as both luxury icon and practical tool watch, creating broad appeal across demographics and geographic regions. The brand’s controlled production and strategic marketing have created sustained demand that supports exceptional resale values.

The Accessible Luxury Segment: Proven Value Retention

Omega Speedmaster and Cartier Tank exemplify how mainstream luxury brands balance heritage with accessibility.

The second tier of luxury watchmaking offers compelling value propositions for collectors seeking genuine horological heritage without extreme price points:

- Omega: Space exploration history, Olympic partnerships, and consistent quality create enduring appeal

- Cartier: Jewelry heritage translated into iconic watch designs with timeless aesthetic appeal

- IWC: Aviation connections and robust engineering attract practical luxury consumers

- Breitling: Aeronautical heritage and distinctive styling maintain collector interest

These brands demonstrate remarkable consistency in their resale performance, offering sellers predictable value retention supported by global dealer networks and established collector communities.

The Independent Revolution: Artisanal Excellence Meets Market Recognition

Independent watchmakers combine traditional craftsmanship with innovative complications, creating highly sought-after collector pieces.

The contemporary watch market has witnessed unprecedented growth in appreciation for independent manufactures:

Established Independents:

- F.P. Journe: Mathematical precision in mechanical complications

- H. Moser & Cie.: Swiss traditionalism with contemporary design sensibilities

- A. Lange & Söhne: German engineering excellence and finishing standards

Emerging Forces:

- Grand Seiko: Japanese precision and finishing techniques gaining global recognition

- MB&F: Artistic horological machines that challenge traditional design conventions

- Urwerk: Futuristic time displays combining innovation with Swiss craftsmanship

Global Market Dynamics: Understanding Modern Collector Behavior

Today’s luxury watch market operates as a sophisticated international ecosystem where regional preferences, cultural trends, and collector psychology interact to create complex pricing dynamics that extend far beyond traditional brand hierarchies.

Cultural Influence vs. Lasting Value: Navigating Market Psychology

The distinction between sustainable appreciation and temporary hype represents a critical consideration for informed sellers. Social media influence, celebrity endorsements, and artificial scarcity can create dramatic short-term price movements that may not reflect long-term collectibility.

A curated selection of collectible timepieces demonstrates the diversity of models that achieve lasting value through different market forces.

Hype-Driven Models:

- Often experience rapid price appreciation followed by equally dramatic corrections

- Driven by social media exposure, influencer culture, and waitlist dynamics

- Require careful timing and market awareness to capitalize effectively

Timeless Classics:

- Offer predictable value retention through enduring design appeal

- Appeal to collectors across multiple generations

- Support stable pricing regardless of contemporary fashion trends

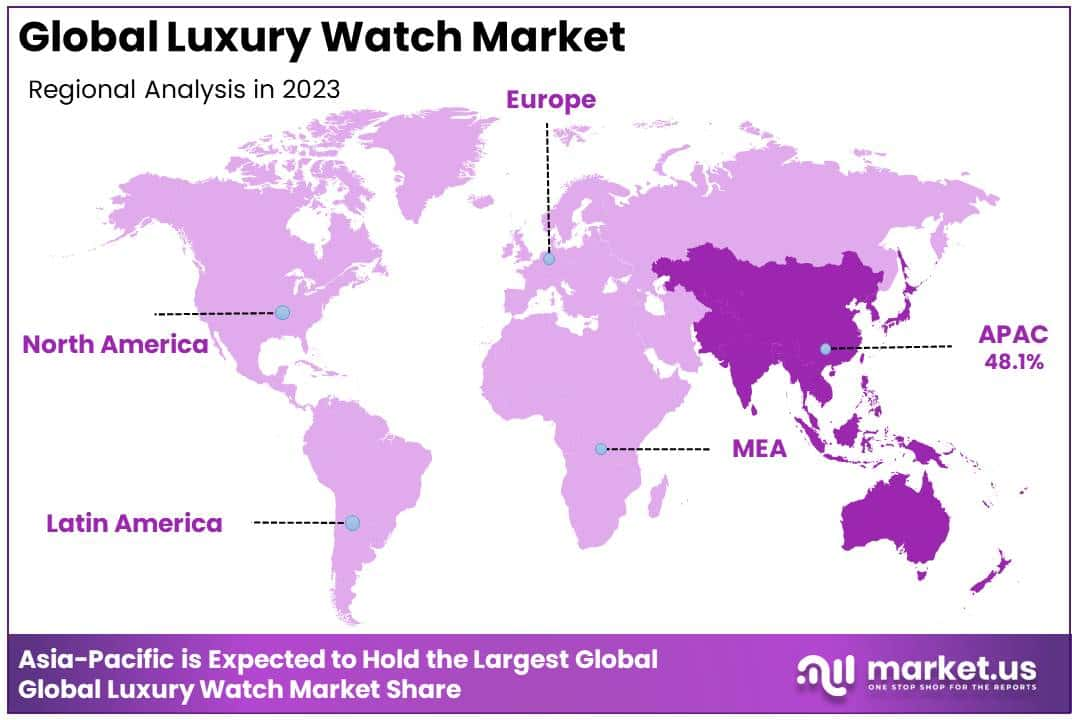

Regional Markets: Maximizing Value Through Global Reach

Understanding regional preferences enables sellers to connect with the most appropriate international markets for their specific timepieces.

International market dynamics create significant opportunities for sellers who understand geographical nuances:

| Region | Preferred Characteristics | Market Advantages |

|---|---|---|

| Europe | Heritage brands, motorsport connections | Premium for vintage Heuer, Breitling |

| Asia-Pacific | Japanese precision, limited editions | Strong Grand Seiko, independent demand |

| North America | Sports watches, investment pieces | Rolex, Patek Philippe leadership |

| Middle East | Precious metals, complications | Gold watches, minute repeaters |

Professional watch dealers leverage these regional variations through global networks that eliminate the limitations of local markets, ensuring every timepiece reaches collectors who most appreciate its specific qualities.

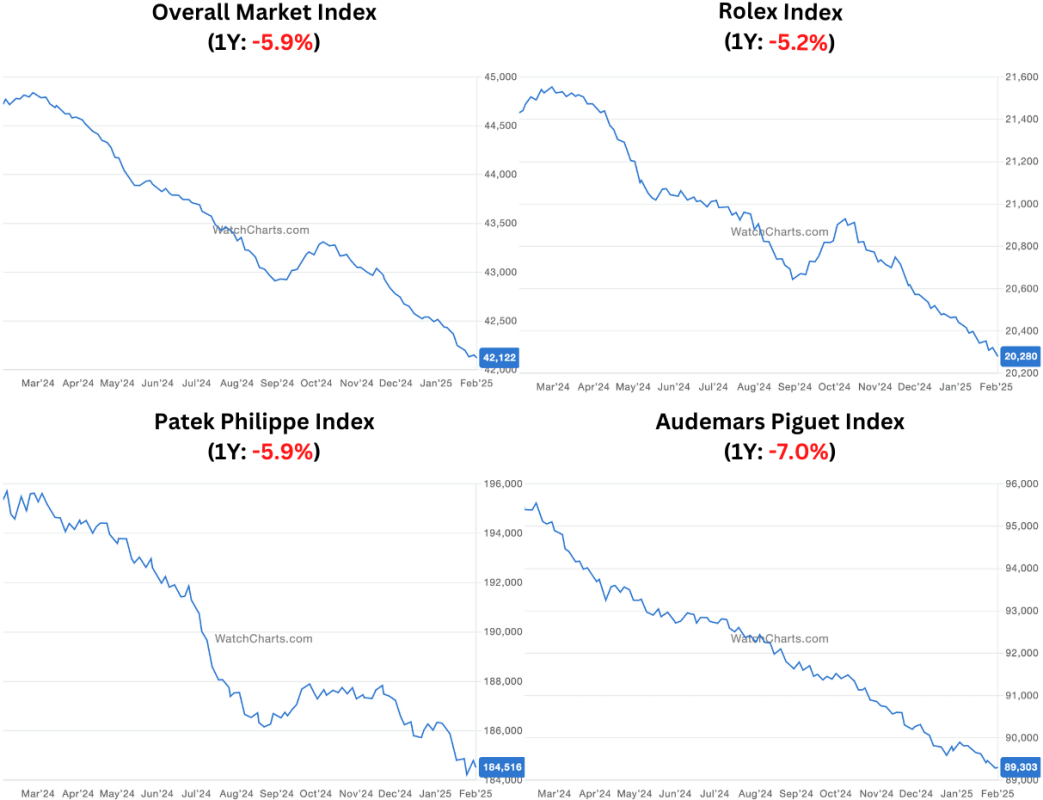

Data-Driven Valuation: Transparency Through Technology

Real-time market analysis transforms subjective opinions into objective, data-backed valuations.

Modern watch evaluation relies on sophisticated analytical tools that process multiple data streams simultaneously:

Primary Data Sources:

- Auction house results from Phillips, Christie’s, Sotheby’s

- Online marketplace trends from Chrono24, WatchCharts

- Dealer transaction records and inventory analysis

- Regional pricing variations and currency impact

Analytical Capabilities:

- Trend identification across multiple timeframes

- Impact assessment of discontinuation announcements

- Celebrity influence and pop culture correlation

- Seasonal demand patterns and economic indicators

This comprehensive approach ensures valuations reflect current market realities rather than outdated assumptions or subjective preferences.

Contemporary Market Trends: Strategic Insights for Sellers

Understanding broader market forces enables sellers to position their timepieces optimally within current collector preferences and economic conditions. These trends reflect the sophisticated interplay between manufacturing decisions, cultural influences, and investment psychology.

The Discontinuation Effect: Scarcity Creates Instant Collectibility

The discontinued Rolex Submariner ‘Hulk’ demonstrates how manufacturing decisions create immediate market premiums.

Discontinuation announcements trigger immediate market disruption as collectors recognize the transition from available product to finite collectible:

Recent Discontinuation Impact:

- Rolex Submariner “Hulk”: 300-400% premium over retail within months

- Patek Philippe Nautilus 5711: Achieved six-figure auction results

- Omega Speedmaster Professional: Limited production variants command premiums

Strategic Considerations:

- Timing sales around discontinuation announcements

- Understanding collector psychology during transition periods

- Recognizing long-term vs. short-term premium sustainability

Material Revolution: Steel Sports Watches Redefine Luxury

The preference for stainless steel over precious metals represents a fundamental shift in luxury watch collecting priorities.

Contemporary collectors increasingly favor versatile timepieces suitable for diverse lifestyle demands:

Stainless Steel Advantages:

- Durability and scratch resistance for daily wear

- Contemporary aesthetic that transcends formal/casual boundaries

- Historical significance in sport watch development

- Lower maintenance requirements compared to precious metals

Market Performance Comparison:

| Material | Premium Segment | Mainstream Luxury | Collector Appeal |

|---|---|---|---|

| Stainless Steel | Often exceeds gold pricing | Strong consistent demand | High versatility factor |

| Yellow Gold | Traditional luxury appeal | Steady collector base | Classic dress watch preference |

| Rose Gold | Contemporary luxury choice | Growing appreciation | Modern aesthetic appeal |

| Platinum | Ultimate precious metal | Limited production appeal | Connoisseur recognition |

Economic and Cultural Influences: The Bigger Picture

Macro-economic factors continue to shape luxury watch markets in unexpected ways, creating opportunities for sellers who understand these broader dynamics.

Vintage timepieces positioned on currency symbolize the growing recognition of watches as alternative investment assets.

Economic Drivers:

- Inflation concerns driving alternative asset interest

- Currency fluctuations affecting international pricing

- Interest rate changes impacting luxury spending patterns

- Stock market volatility encouraging tangible asset allocation

Cultural Phenomena:

- Movie and television appearances creating sudden demand spikes

- Social media influence on younger collector demographics

- Sustainability concerns favoring vintage over new production

- Gender-neutral collecting trends expanding market participation

The pre-owned luxury watch market rewards knowledge, patience, and strategic thinking. Success requires understanding brand hierarchies, recognizing global demand patterns, and timing decisions within broader economic cycles.

A diverse collection represents the sophisticated approach modern collectors take toward building portfolios that balance passion with investment potential.

Whether you own an iconic Rolex, an innovative independent creation, or a vintage treasure, the global luxury watch market offers compelling opportunities for sellers who approach transactions with comprehensive market understanding. The key lies in partnering with professionals who combine traditional horological expertise with modern analytical capabilities, ensuring every timepiece achieves its optimal market value through transparent, data-driven evaluation processes.

By recognizing the interplay between brand heritage, global demand, and contemporary trends, sellers can navigate this sophisticated market with confidence, knowing their cherished timepieces will find appreciative collectors willing to pay fair market premiums for genuine horological excellence.